are car loan interest payments tax deductible

For example you cannot deduct the total cost of any discount points you pay at closing in the year you get your new loan. Car loans are personal finance products so private buyers cant claim back any of the costs when it comes to their tax return.

Auto Loans And Car Loan Financing New Used Becu

Dealing with illicit tobacco duty and excise evasion.

. There are a few rules. Interest paid on personal loans car loans and credit cards is generally not tax deductible. If you have a big income and are in a high tax bracket the mortgage interest deduction can be useful in holding down your income tax payment and your entire.

For some investors thats a financial plus and makes an interest-only loan desirable. Mortgage interest paid on home loans of as much as 1 million is deductible. Student loan interest is not tax deductible but it may be eligible to claim on line 31900 of your tax return as a non-refundable tax credit.

In finance a loan is the lending of money by one or more individuals organizations or other entities to other individuals organizations etc. Student loan interest. Some new rules also apply to refinances.

Or all of the interest on the loan is tax deductible. Depreciating value A car starts to depreciate the moment you drive it off the lot warns Walters. You save 4647 even though the car interest rates and residual for both of the above after-tax pay outcomes are identical.

In general you can deduct interest paid on money you borrow to invest although there are restrictions on how much you can deduct and which investments actually qualify you for the deduction. There is an above-the-line deduction that allows taxpayers with qualifying student loans to deduct as much as 2500 in student loan interest per year. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

As a self-employed worker the main advantage of leasing a car is that you are allowed to deduct lease payments in the way you couldnt deduct a car payment for a loan amount. Higher monthly payments The monthly payments for a loan are almost always higher than a lease. Targeting intermediaries and agents who enable black economy behaviour.

With a loan youll be paying for the entire cost of the vehicle. In some cases those interest costs are tax-deductiblewhich is one more reason not to ignore them. If you use a passenger vehicle or zero-emmission vehicle as defined by the CRA deduct the lesser of.

Car fees go on the line for state and local personal property taxes Note that your state might not specifically refer to the fee as a personal property tax. No Tax-deductible Element. Novated lease Vs car loan has got a lot to do with tax.

Nevertheless if the fee is value-based and assessed on a yearly basis the IRS considers it. Among them is the deduction for investment interest expenses. The document evidencing the debt eg a promissory note will normally.

In the past homeowners were able to deduct interest paid on up to 100000 of home equity loan debt for any reason but the 2018 tax law no longer allows the deduction of interest paid on HELOCs and home equity debt unless it is obtained to build or substantially improve the homeowners dwelling. With a lease youre just covering the depreciating value of the car. The federal tax code includes a number of incentives to encourage investment.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. In other cases interest is simply the price you pay for using someone elses money. But there is one exception to this rule.

Under the new tax law your insurance payments arent considered tax deductible. The recipient ie the borrower incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. Interest you paid on a loan used to buy the motor vehicle.

1 total annual interest paid or 2 1000 multiplied by the number of days you paid interest. On the other hand if you buy a new car as long as you use it for business at least 50 percent of the time you are allowed to deduct its depreciation value over the. Typically deducting car loan interest is not allowed.

Tax deductions are not the same as credits. Interest effectively raises the price of the things you buy whether its a new home a car or equipment for your business. The Australian Taxation Office ATO today reminded employers that any cash in hand payments made to workers from 1 July 2019 will not be tax deductible.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. However you may deduct them over the course of your new loan. 18 Jun 2019 QC 59330.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Tenure Us Home Loans Loan Calculator Loan

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

Is Car Loan Interest Tax Deductible

How To Pay Off Your Car Loan Early Paying Off Car Loan Car Loans Car Finance

How Does Car Loan Interest Work Bmo

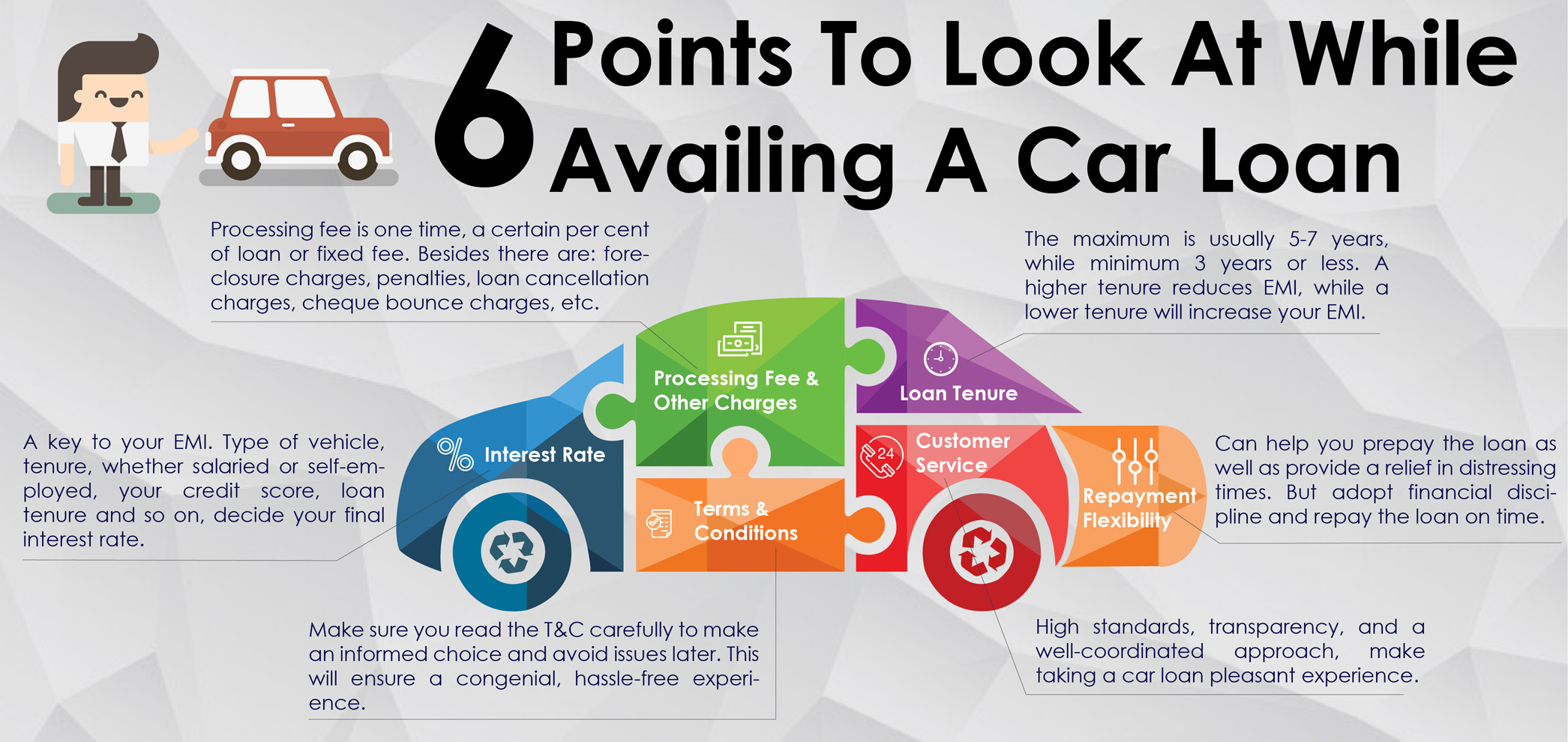

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

Is Car Loan Interest Tax Deductible In The Uk

Charging India S Green Future Sbi Is Proud To Provide India S First Green Car Loan To Encourage People To Reduce Their Ca Green Car Car Loans Carbon Footprint

Car Loan Tax Benefits And How To Claim It Icici Bank

Car Loans For Teens What You Need To Know Credit Karma

Car Loan Payment Deferrals Loans Canada

Buying Vs Leasing A Car In Germany Pros And Cons

A Guide To Car Loans Interest Rates In Malaysia

Is Zero Percent Car Loans Really A Good Deal Or Is It A Dealership Trick Quora

.jpg)